IRS WAGE GARNISHMENT

G-Tax can help you avoid an IRS wage garnishment. Your tax expert understands the nuts, bolts and nuances of your financial life — including how tax matters impact your life.

As a successful professional, you’re well aware of the conditions that are most conducive to your success. When every detail of your venture fits neatly with the next, you create a well-oiled machine that runs flawlessly. You know that any glitch in the machinations has the potential for far-reaching consequences that can affect your livelihood and your future.

If you’re facing wages garnishment by the IRS, you’ve had other opportunities to stop it or to correct the situation. Now let your tax expert handle things from start to finish.

Don’t let financial intrusions get in the way of your day-to-day operations. Your finances flow more smoothly when you work with an G-Tax consultant. A tax expert can perform quarterly tax reviews and annual audits to help you avoid an IRS wage garnishment. Your tax expert understands the nuts, bolts and nuances of your financial life — including how tax matters impact your life. Let Miller & Company keep you successful and free of encumbrances.

STAY ON TOP OF YOUR TAXES

If you fall behind on your taxes, the IRS can take steps to recover what it believes you owe. If there’s one government agency that can take drastic steps against you, it’s the IRS. Some of the measures the IRS can use against you include:

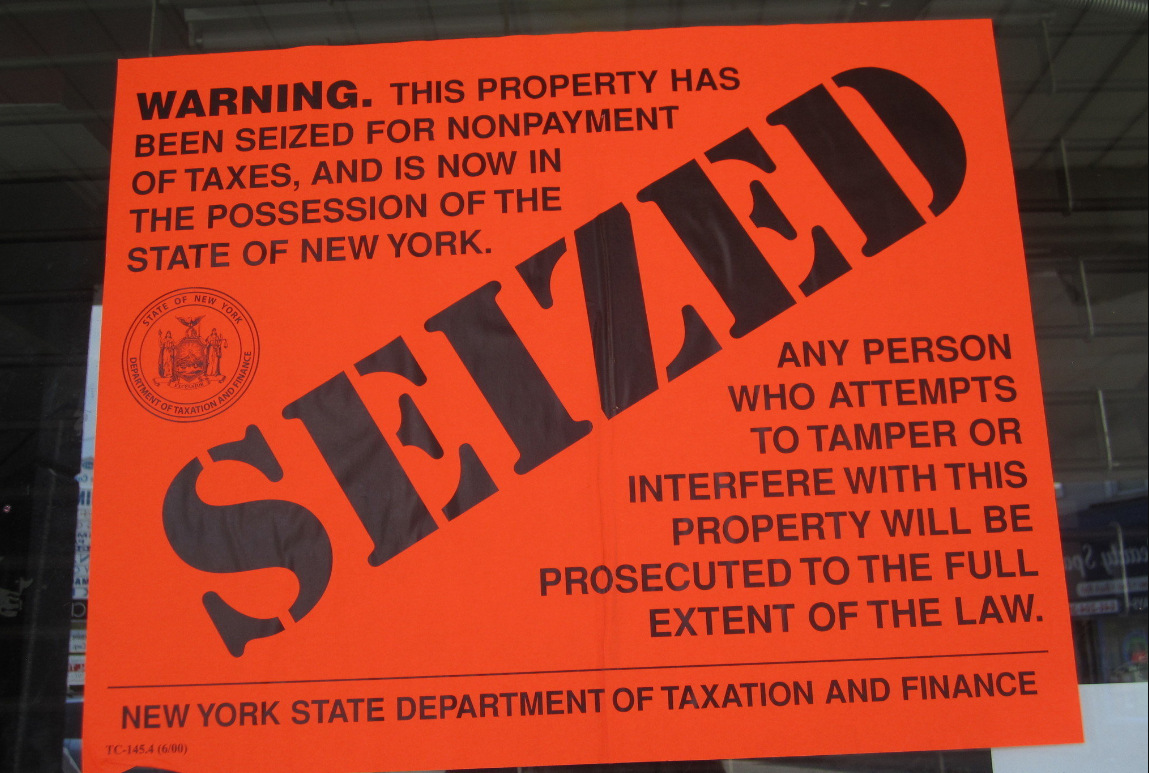

- Placing a lien on your property

- Hitting you with a tax levy, which allows the IRS to seize your property

- Garnishing your wages

The IRS has the right to garnish your wages if you owe back taxes. While not filing your tax returns is a criminal offense, owing back taxes isn’t necessarily the result of criminal activity. It could be anything from a typographical error to a misunderstanding of a court document or confusion about the tax forms — all the more reason to work with an accounting firm that has a deep understanding of tax codes and the guidelines for compliance.

IRS wage garnishment is typically a last resort. The IRS first tries other methods to get you to pay the back taxes you owe. They try to entice you to participate in programs such as one of the IRS payment plans. If those methods are unsuccessful and you still owe taxes, the IRS can move forward with wage garnishment.

WHAT IS WAGE GARNISHMENT?

Before you receive a notice of IRS wage garnishment, you’ve had the chance to ask for a hearing or to pay your back taxes. Once you receive a notice of garnishment, you must comply with the levy. The IRS has strict guidelines when garnishing your wages, so you won’t be left penniless, just a little poorer while your taxes are getting paid off.

Unlike other creditors, the IRS doesn’t take a set amount from your wages. Instead, they have guidelines that determine how much pay you get to keep to cover basic living expenses. Everything above that amount gets garnished to pay your tax debt. The guidelines that determine your exemption are based on your tax filing status and exemptions.

HOW IRS WAGE GARNISHMENT WORKS

Here’s an example based on the IRS Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income. Let’s say you’re paid weekly. The IRS garnishes your wages until your tax debt is paid. If the IRS deems that you need $755 of your wages to live, that amount is protected. The IRS can take all of your weekly wages above that amount. The protected amount remains the same, whether you earn $800 or $8,000 a week.

When your company receives a notice that your wages are to be garnished, the notice provides instructions for calculating what they’ll continue to pay you. Your company also receives a Statement of Exemptions and Filing Status, which they’ll give copies to you within three days. The IRS typically gives your employer one full pay cycle to get the paperwork completed.

Once the levy begins, your paycheck shrinks to whatever has been decided you need. Everything else goes straight to the IRS. The levy remains in effect until it’s released by the IRS.

PRECISION AND CARE

The time to skimp on professional financial consulting is not when you’re dealing with the IRS. Contact a professional who takes s big-picture view of your finances and an integrated approach to accounting. Your tax expert can handle any potential challenges — including IRS wage garnishments. G-Tax has a solid foundation, combining keen financial acuity with a genuine interest in your financial well-being.

Your tax experts investigate the IRS’ claims and arrange for any necessary hearings. They look for potential errors, review plans for repayment and find ways to mitigate any inconvenience caused by the levy, with a careful eye on the future. They research your accounts and look at how to best resolve the issue of a possible IRS wage garnishment. Miller & Company accountants work to grow your financial portfolio for the long haul. There’s more to life than making money, but your life and lifestyle are intimately tied up in your income and expenses.

COMPLEX AND CONSTANTLY CHANGING

Not everyone needs the services of a high-powered accounting firm to manage their taxes. Someone of your status, however, needs more than just a capable accountant to keep the IRS from garnishing your wages. Tax laws and IRS regulations are constantly changing, and you need a firm of professionals that not only know how the IRS works but also have extensive experience working to protect your assets.

You need upscale accounting that acknowledges a fundamental awareness that there is no one-size-fits-all track to success. You need a professional who shows a willingness to go above and beyond what you’d expect from an ordinary accounting firm. After all, your business is anything but ordinary.

With G-Tax, you’ll work with a personal tax advisor who’s familiar with the details of your financial portfolio. Your tax expert knows the right questions to ask to help you out of your problems with the IRS. If you find yourself with questions about wage garnishment, this team of professionals is armed with the most up-to-date information and years of experience to ensure the best possible outcome.